lincoln ne sales tax increase

The Lincoln City Council still has to vote on whether to ask voters to raise the sales tax to 175 percent. The Nebraska state sales and use tax rate is 55 055.

Esposito said theres a lot of support for the idea.

/cloudfront-us-east-1.images.arcpublishing.com/gray/KX4IFSPUWRNTZL56FJJKSPUMF4.jpg)

. The official final results show 5065 percent of. Replacement of the Citys emergency 911 radio system and the construction andor relocation of four. With unofficial final votes counted the increase won 21800 votes to.

3 rows 025 lower than the maximum sales tax in NE. It was approved. A yes vote was a vote in favor of authorizing the city to increase the local sales tax by an additional 025 percent a quarter cent for six years to fund street improvements.

Simplify Nebraska sales tax compliance. A sales tax measure was on the ballot for Lincoln voters in Lancaster County Nebraska on April 9 2019. LINCOLN NE Americans for Prosperity-Nebraska today urged the Lincoln City Council to abandon Mayor Chris Beutlers proposal to include a 13 million annual sales tax hike on the April 9 primary ballot.

Click here to get more information. The 725 sales tax rate in Lincoln. 55 Rate Card 6 Rate Card 65 Rate Card 7 Rate Card 725 Rate Card 75 Rate Card 8 Rate Card Nebraska Jurisdictions with Local Sales and Use Tax Local Sales and Use Tax Rates Effective January 1 2021 Local Sales and Use Tax Rates Effective April 1 2021.

The local sales and use tax rate in Chadron will increase from 15 to 2. Lincoln voters approved a limited sales tax increase Tuesday that would raise 345 million to replace the citys aging emergency radio system and. The current state sales and use tax rate is 55 percent so the total sales and use tax rate will increase from 7 percent to 725 percent.

Over the last three years the city of Lincoln has been able to repair and build more roads than normal thanks to voter approving a quarter-cent sales tax increase in 2019. It was a close vote but Lincoln residents will see a quarter cent sales tax increase on October 1. A no vote was a vote against authorizing the city to increase the local.

We provide sales tax rate databases for businesses who manage their own sales taxes and can also connect you with firms that can completely automate the sales tax calculation and filing process. In Lincoln the local sales and use tax rate will jump from 15 to 175. Lincoln voters approved the 14-cent increase in April to support two important public safety projects.

Raised from 55 to 6. At some point Mayor Beutler and the Lincoln City Council need to start planning ahead for expenditures and stop raising taxes in order to pay for projects. Increase City Sales Tax by ¼ for a total of 1¾ Actual Wording Explanation CITY OF LINCOLN BALLOT QUESTION Shall the City Council of Lincoln Nebraska increase the local sales and use tax rate by one quarter of one per cent 14 upon the same transactions within such municipality on which the State of Nebraska is authorized to impose a.

Voters Tuesday favored raising the citys sales tax by a quarter-cent.

Charles Apple 신문 디자인 레이아웃 레이아웃 신문 디자인

Sales Tax By State Should You Charge Sales Tax On Digital Products Taxjar

What S The Car Sales Tax In Each State Find The Best Car Price

Today S Ljs Is The Last Edition Printed In Lincoln Endofanera Signsofprogress Star Signs Instagram Prints

What Is Georgia S Sales Tax Discover The Georgia Sales Tax Rate For 159 Counties

Nebraska Sales Tax Rates By City County 2022

What S The Car Sales Tax In Each State Find The Best Car Price

Nebraska Sales Tax Small Business Guide Truic

How To Avoid Paying Car Sales Tax The Legal Way Find The Best Car Price

Everything You Need To Know About Restaurant Taxes

How To Register For A Sales Tax Permit Taxjar

United States Drought Monitor Home Drought California Drought Water Crisis

/cloudfront-us-east-1.images.arcpublishing.com/gray/KX4IFSPUWRNTZL56FJJKSPUMF4.jpg)

Lincoln To See New Sales Tax Revenue Starting October 1

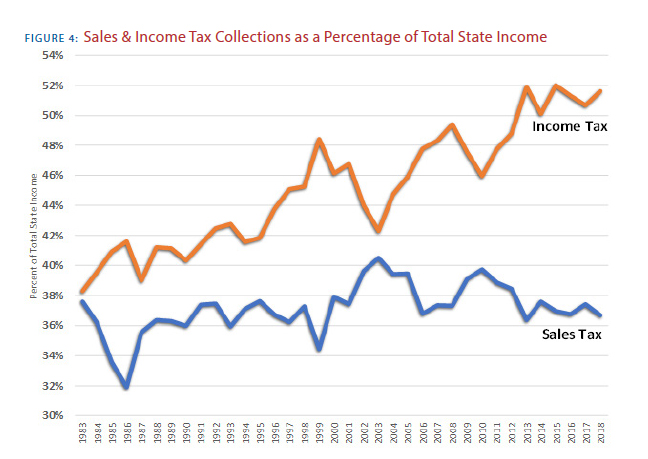

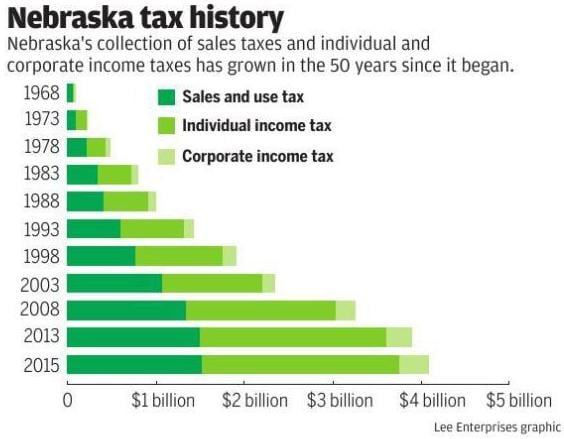

50 Years Ago Nebraskans Aroused To The Point Of Fury Over Taxes Regional Government Journalstar Com